Verify owner ID with Companies House

UK Company Owners: Verify ID with Companies House by Nov 2025

Introduction: A New Era of Corporate Transparency in the UK

In a bold move to clamp down on economic crime, the UK government is mandating identity verification for all company directors and Persons with Significant Control (PSCs) with Companies House, effective from 18 November 2025. This landmark requirement stems from the Economic Crime and Corporate Transparency Act 2023, a comprehensive legislative response to years of vulnerabilities exposed in the UK’s company registry. The goal is straightforward yet transformative: ensure that every individual behind a UK company is real, identifiable, and accountable, thereby curbing fraud, money laundering, and the proliferation of shell companies.

Historically, Companies House has operated as one of the world’s most open corporate registries, allowing anonymous registrations with minimal checks. This openness, while fostering a business-friendly environment, has been exploited think of the 793,000 companies flagged as suspicious in 2023 alone, or high-profile scandals like the 2018 collapse of Carillion, where opaque ownership structures hid mismanagement. The new rules mark a pivotal shift, aligning the UK with global standards like the EU’s Anti-Money Laundering Directives and the US’s Corporate Transparency Act of 2021. This article dissects the policy from multiple angles legal, practical, economic, and societal while speculating on its long-term ripples. We’ll cover who must comply, deadlines, step-by-step processes, risks of non-compliance, and broader implications, complete with a handy checklist.

Who Must Verify? Defining the Scope of the Mandate

The verification net is wide but precisely cast, targeting those with real power in UK entities:

– All directors of private and public limited companies.

– Persons with Significant Control (PSCs) anyone owning or controlling over 25% of shares/voting rights, or exerting “significant influence.”

– Members and designated members of LLPs.

– Directors of overseas companies with UK establishments.

Exempt for now are corporate directors/PSCs (e.g., a company as a director); dedicated rules for them are slated for later phases. Upon verification, individuals receive a unique Companies House personal code, reusable across roles but requiring separate linkage per appointment. For instance, a serial entrepreneur directing five firms submits the code five times.

From a legal perspective, this closes loopholes exploited by criminals. PSCs, introduced in 2016 via the Small Business, Enterprise and Employment Act, were a first step toward transparency, but without ID checks, fake identities proliferated. Economically, it protects legitimate businesses: the UK loses £100 billion+ annually to fraud, per government estimates.

Societal lens: Critics argue it burdens sole traders and family businesses, but proponents highlight equity why should honest owners compete with ghost entities? Internationally, it’s akin to Singapore’s 2017 beneficial ownership registers, which slashed illicit finance by 30% in pilot tests.

Deadlines and Transitional Grace: A Phased Rollout Explained

No blanket deadline eases the burden via a 12-month transitional period:

| Category | Deadline Details | ||

|---|---|---|---|

| New Appointments (post-18 Nov 2025) | Verify before registration; PSCs within 14 days of PSC register entry. | ||

| Existing Directors | Before filing the first Confirmation Statement due after 18 Nov 2025 (e.g., June 2026 due date = verify by then). | ||

| Existing PSCs (non-directors) | 14 days from company’s next Confirmation Statement or PSC status date. | ||

| Overseas UK Entities | First anniversary of UK registration post-18 Nov 2025. |

Voluntary verification opened 8 April 2025, with over 1 million early adopters. From 13 October 2025, GOV.UK One Login becomes mandatory for all Companies House online services verify now to sidestep chaos.

Historical parallel: This mirrors the 2016 PSC register rollout, which faced teething issues but ultimately registered 5 million+ individuals. The phased approach learns from that, avoiding the 2020 Brexit filing backlogs.

Step-by-Step Verification: Free, Fast, and Foolproof

Verification is user-friendly, taking 5-15 minutes at no cost via self-service.

Direct Method (Free and Recommended)

1. Visit GOV.UK Verify or Companies House portal.

2. Create/sign into GOV.UK One Login.

3. Prepare docs: biometric UK/EEA passport, UK photocard driving licence (full/provisional), biometric residence permit (BRP), or Frontier Worker permit.

4. Upload photo/scan of document + live selfie video.

5. Approval (instant or minutes) → Personal code emailed and stored in your account.

Via Authorised Corporate Service Provider (ACSP)

Accountants/lawyers handle it for a fee, using the same system ideal for non-tech-savvy owners.

Post-Verification:

– Link code via “Provide identity verification details” service per role.

– Company files a verification statement.

Unverified filings (e.g., accounts, director changes) get rejected.

Practical tip: Test now early birds report seamless experiences, unlike rushed NHS app launches.

Risks of Non-Compliance: From Warnings to Prosecution

Ignore at your peril:

– Public register flags unverified status.

– Filing blocks halt operations.

– Civil penalties for directors/PSCs; criminal charges in egregious cases (fines up to £30,000+, imprisonment).

Economic analysis: Non-compliance could spike insolvency rates short-term, as seen in Australia’s 2019 ID rules, where 10% of SMEs faced temporary paralysis before adapting.

Perspectives: Analyzing the Policy’s Multifaceted Impact

Fraud Prevention and National Security

The core win: dismantling shell companies. UK data shows 40% of economic crime links to fake directors. Post-2025, expect a 20-50% drop in suspicious filings, per ICAEW forecasts echoing Estonia’s e-residency ID checks, which cut fraud by 60%.

Business and Compliance Burden

SMEs gripe about admin load (estimated 1-2 hours per person), but digital tools minimize it. Larger firms benefit via cleaner supply chains. Speculation: Automation (AI-driven verification) could evolve by 2030, reducing burdens 80%.

Privacy vs. Transparency Debate

Critics (e.g., Open Rights Group) decry data risks centralized IDs invite hacks. Yet, GOV.UK’s security rivals banks’. Future outlook: Blockchain integration (piloted in 2024) may enable “zero-knowledge” proofs, verifying without exposing data.

Global Competitiveness

UK joins FATF’s “gold standard” peers, attracting ethical FDI. But over-regulation risks capital flight to lax jurisdictions like UAE unless harmonized globally.

Historical reference: The 2008 financial crisis birthed Dodd-Frank’s ownership disclosures; UK’s Act preempts similar reckoning.

Future Speculations: Reshaping UK Business by 2030

Short-term (2026-27): Expect 2-5 million verifications, initial backlogs, then smooth sailing. Fraud prosecutions rise 30%, per NCA predictions.

Medium-term: Enhanced AI at Companies House flags anomalies in real-time, birthing “trust scores” for companies boosting lending (banks hate opacity).

Long-term: Paradigm shift to a “verified economy.” Shell companies plummet 70%, legit firms gain investor confidence, GDP lifts 1-2% via reduced crime costs. Internationally, it pressures tax havens; by 2035, a global ID standard emerges, with UK leading via Commonwealth ties.

Risks: Cyber threats or populist backlash could dilute enforcement, à la post-Brexit red tape revolts. Optimistically, it cements UK as Europe’s anti-crime hub.

Similarities to past reforms: Like the 1844 Joint Stock Companies Act birthing limited liability (with accountability checks), this fortifies capitalism’s foundations.

Summary Checklist: Your Compliance Roadmap

– [ ] Verify today via GOV.UK (free, <15 mins).

- [ ] Use biometric passport/driving licence/BRP + selfie.

- [ ] Secure personal code and link to all roles.

– [ ] Confirm before next Confirmation Statement post-18 Nov 2025.

– [ ] Monitor official guidance.

Act now compliance isn’t optional; it’s the future of UK business. Early movers thrive; laggards falter.

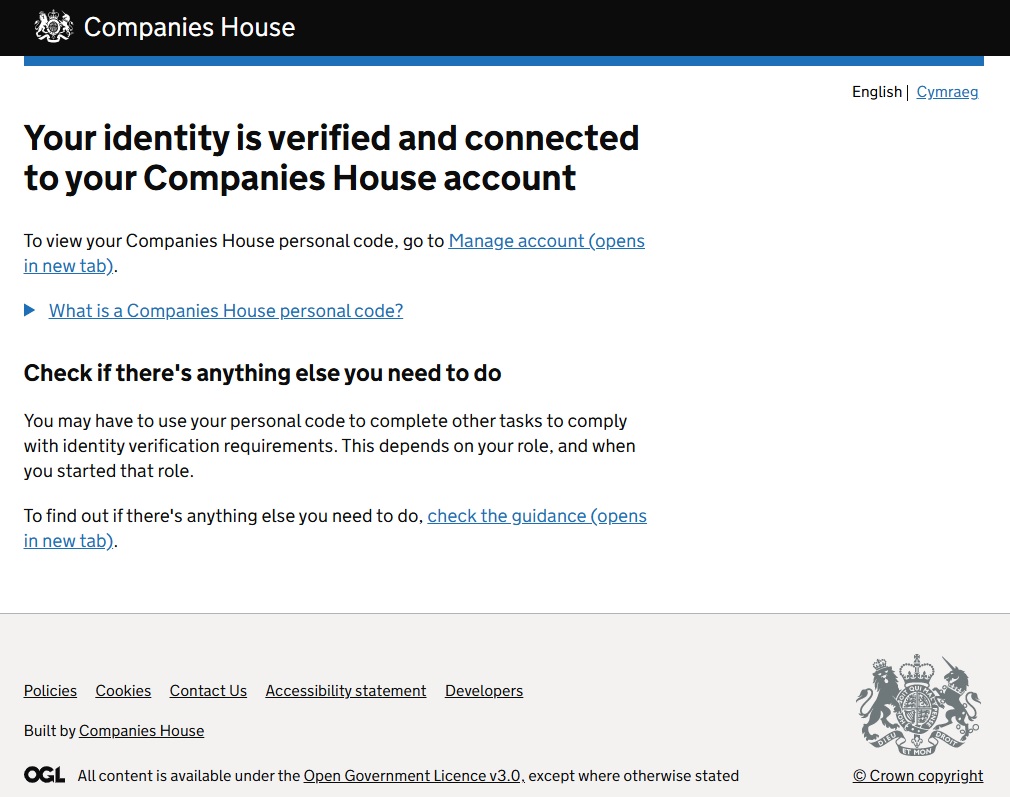

After successul verification you should see following information:

As I reflect on this push for mandatory ID verification at Companies House, a quiet unease stirs within me I’ve always cherished the UK’s registry as a beacon of entrepreneurial freedom, where ideas could flourish without the weight of surveillance. The article paints it as a triumphant clampdown on fraud, yet I wonder if we’re trading one vulnerability for another: a centralized database ripe for breaches, eroding the privacy that fuels innovation.

In my years advising startups as a compliance consultant, I’ve seen legitimate founders deterred by red tape once, a tech innovator abandoned a UK incorporation for Estonia’s lighter-touch system, citing the hassle over any fraud fears. Doesn’t this risk pushing creators offshore, stifling the very economy it aims to protect? What safeguards will truly prevent overreach?

Makayla, your thoughtful reflection on the ID verification push at Companies House truly deserves credit your startup advising experience brings such grounded insight into how red tape can quietly chase innovators away, like that tech founder fleeing to Estonia.

Congrats to the author for sparking this vital debate!

What if we explored hybrid possibilities, blending verification with privacy tech like zero-knowledge proofs to verify without exposing? As someone fascinated by resilient systems (much like how today’s Jim Beam halting production for a year amid US distillers’ tariff turmoil shows uncertainty’s ripple effects), I wonder if over-centralization could similarly brew economic droughts here pushing UK creators offshore while fraudsters adapt anyway. Could decentralized registries be the next frontier for entrepreneurial freedom?

Companies House goes full decentralized registry, and suddenly every Tom, Dick, and fraudulent Harry sets up a “Decentralized Dogecoin Emporium Ltd” from their mum’s basement. Economic droughts? Mate, that’s a tsunami of scams washing away legit startups. I’ve been knee-deep in this startup swamp myself ran a little fintech side-hustle back in the day that got buried under paperwork avalanches. My worldview? Bureaucracy is the dad joke of governance: unfunny, unavoidable, and always there to cramp your style. But ditching ID verification entirely? That’s like Trump saying, “Iraq, you’re on your own, bro no more help, good luck!” and then watching Baghdad turn into Mad Max.

Questioning your offshore push: Estonia’s e-residency is cool for digital nomads, but it’s basically a Baltic beach party for tax dodgers. UK creators fleeing red tape? Please most are just allergic to filling out forms properly. Fraudsters adapt anyway? Yeah, like cockroaches at a nuclear picnic, but verified IDs at least make them wear name tags. Decentralized registries as the next frontier? Sounds futuristic, but I’d bet my last pint it’s more vaporware than Ethereum. Let’s stick to verifying owners like Trump verifies loyalty harsh, but gets the job done. Otherwise, Companies House becomes the Wild West, and we’ll all be panning for gold in a river of snake oil.

Congrats to the author too keep stirring the pot! Who’s with me for mandatory ID checks with a side of dad jokes to lighten the load?