Inflation in Argentina – economic analysis

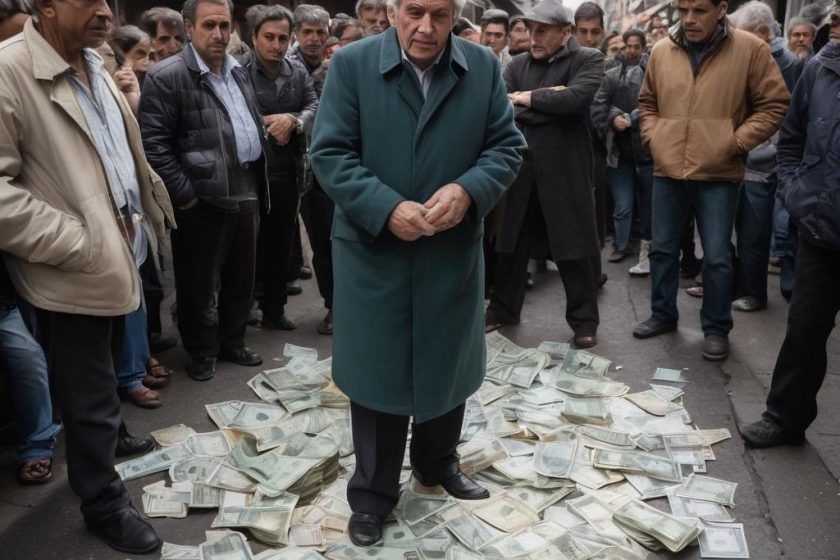

Argentina’s Inflation Soars: Experts Cut 2024 Forecast to Alarming 123% Amid Economic Turmoil and Currency Devaluation

In a devastating blow to the already fragile Argentine economy, analysts have drastically revised their forecasts for inflation in 2024. The alarming news comes as a stark reminder of the economic turmoil that has been engulfing Argentina, with August’s monthly inflation rate standing at an eye-watering 3.9%. According to a survey published by the central bank on Thursday, this staggering figure is expected to result in an annualized inflation rate of nearly 123% by the end of the year.

This significant reduction from last month’s forecast serves as a stark warning sign for President Javier Milei’s government, which has been struggling to contain the economic fallout of its deep spending cuts. The devaluation of the peso currency, Argentina’s official currency, has also played a significant role in exacerbating inflationary pressures, leaving many experts forecasting a dire future for the country’s economy.

The reasons behind this drastic increase in prices are complex and multifaceted. Analysts point to a combination of factors, including the government’s austerity measures, which have led to widespread job losses and reduced consumer spending power. Additionally, the devaluation of the peso has made imports more expensive, further fueling inflationary pressures.

The economic consequences of this inflation surge are far-reaching and devastating. With a projected 3.5% year-on-year drop in Argentina’s real gross domestic product (GDP) for 2024, many experts fear that the country is heading into a prolonged period of economic hardship. The forecast from analysts suggests that inflationary pressures may continue into next year but are anticipated to be somewhat less severe by then.

However, this news has not gone unnoticed, and President Milei’s government is under increasing pressure to find solutions to alleviate this economic burden on its citizens. The forecast from analysts serves as a stark reminder of the urgent need for corrective measures to address this surge in inflation and stabilize the economy.

The impact of Argentina’s inflation surge extends far beyond the country’s borders, with stock markets and cryptocurrency markets also feeling the effects of fears about the potential collapse of the Argentine economy. This has resulted in significant price swings for investors holding assets denominated in the peso and may indicate a broader trend towards asset protection or even an increase in inflation expectations globally.

As the future prospects for Argentina’s economy remain uncertain, many experts are forecasting more economic hardships ahead if corrective measures are not taken promptly by the government to address this surge in inflation. The situation is further complicated by the country’s complex economic relationships with major trading partners and investors, who may be hesitant to invest in a country experiencing such high levels of inflation.

In an effort to contain the economic fallout, President Milei has announced plans to implement a series of measures aimed at reducing inflationary pressures and stabilizing the economy. These measures include a combination of monetary policy tools, fiscal austerity measures, and structural reforms designed to improve the business climate and promote economic growth.

However, these efforts are unlikely to yield immediate results, and experts warn that the country may be facing a prolonged period of economic hardship. The situation is further complicated by the fact that Argentina’s economy has been struggling with high inflation rates for several years, making it increasingly challenging to stabilize the currency and control prices.

As the situation in Argentina continues to deteriorate, many are left wondering whether the government will be able to contain the economic fallout and implement effective solutions to alleviate this surge in inflation. The future prospects for Argentina’s economy remain uncertain, but one thing is clear: the country is facing a major economic crisis that requires immediate attention and action.

Economic Analysis

The inflation surge in Argentina is a stark reminder of the economic turmoil that has been engulfing the country. Analysts have sharply revised their forecasts for inflation in 2024, with an alarming annualized rate of nearly 123% expected by the end of the year. This marks a significant reduction from last month’s forecast and serves as a warning sign for President Milei’s government.

The reasons behind this drastic increase in prices are complex and multifaceted. Analysts point to a combination of factors, including deep spending cuts implemented by the government, which have led to widespread job losses and reduced consumer spending power. Additionally, the devaluation of the peso has made imports more expensive, further fueling inflationary pressures.

The economic consequences of this inflation surge are far-reaching and devastating. With a projected 3.5% year-on-year drop in Argentina’s real GDP for 2024, many experts fear that the country is heading into a prolonged period of economic hardship. The forecast from analysts suggests that inflationary pressures may continue into next year but are anticipated to be somewhat less severe by then.

The impact of Argentina’s inflation surge extends far beyond the country’s borders, with stock markets and cryptocurrency markets also feeling the effects of fears about the potential collapse of the Argentine economy. This has resulted in significant price swings for investors holding assets denominated in the peso and may indicate a broader trend towards asset protection or even an increase in inflation expectations globally.

Government Response

In response to this crisis, President Milei’s government has announced plans to implement a series of measures aimed at reducing inflationary pressures and stabilizing the economy. These measures include a combination of monetary policy tools, fiscal austerity measures, and structural reforms designed to improve the business climate and promote economic growth.

However, these efforts are unlikely to yield immediate results, and experts warn that the country may be facing a prolonged period of economic hardship. The situation is further complicated by the fact that Argentina’s economy has been struggling with high inflation rates for several years, making it increasingly challenging to stabilize the currency and control prices.

Impact on Global Economy

The impact of Argentina’s inflation surge extends far beyond its borders, with stock markets and cryptocurrency markets also feeling the effects. This has resulted in significant price swings for investors holding assets denominated in the peso and may indicate a broader trend towards asset protection or even an increase in inflation expectations globally.

As the situation in Argentina continues to deteriorate, many are left wondering whether the government will be able to contain the economic fallout and implement effective solutions to alleviate this surge in inflation. The future prospects for Argentina’s economy remain uncertain, but one thing is clear: the country is facing a major economic crisis that requires immediate attention and action.

Conclusion

In conclusion, Argentina’s inflation surge serves as a stark reminder of the economic turmoil that has been engulfing the country. Analysts have sharply revised their forecasts for inflation in 2024, with an alarming annualized rate of nearly 123% expected by the end of the year.

The reasons behind this drastic increase in prices are complex and multifaceted, including deep spending cuts implemented by the government, which have led to widespread job losses and reduced consumer spending power. Additionally, the devaluation of the peso has made imports more expensive, further fueling inflationary pressures.

The economic consequences of this inflation surge are far-reaching and devastating, with a projected 3.5% year-on-year drop in Argentina’s real GDP for 2024. The forecast from analysts suggests that inflationary pressures may continue into next year but are anticipated to be somewhat less severe by then.

As the future prospects for Argentina’s economy remain uncertain, many experts are forecasting more economic hardships ahead if corrective measures are not taken promptly by the government to address this surge in inflation.

In a shocking turn of events, one that will surely delight our author’s insatiable appetite for catastrophe, it seems that Argentina’s inflation rate has soared to alarming heights. Meanwhile, back on the home front, England’s 11 million renters are basking in the warm glow of proposed legislation that will grant them more security against no-fault evictions. But let’s not get distracted by such mundane details – after all, who needs stability and security when there’s inflation to be had? In fact, I’d venture to say that our author is secretly thrilled by Argentina’s economic woes, if only because they provide a welcome respite from the tedium of everyday life. So here’s my expert tip: instead of warning readers about the impending doom that awaits them, perhaps our author should focus on providing actionable advice – like how to invest in cryptocurrency or where to find the best deals on imported goods. But then again, that would require actual expertise and not just a flair for the dramatic.

I strongly disagree with Killian’s argument that Argentina’s inflation rate is a welcome respite from the tedium of everyday life. The fact remains that high inflation rates can have devastating consequences on people’s purchasing power and economic stability, as evidenced by today’s news about Libya’s fragile truce steadying oil prices amid ongoing volatility. Rather than focusing on sensationalism, I believe our author should provide a more nuanced analysis of the underlying causes of Argentina’s economic woes and offer practical solutions to mitigate their impact on the population.

Killian, your comment is as entertaining as it is misguided. While I agree that the current economic situation in Argentina is dire, I must take issue with your characterization of our author’s intent. The article is meant to inform and educate, not to sensationalize or revel in catastrophe.

In fact, I’m reminded of today’s news from Kenya, where President Ruto has made an urgent call for funding to support a police mission in Haiti. This highlights the very real consequences of economic instability and the need for careful analysis and consideration.

As for your suggestion that our author provide actionable advice on investing in cryptocurrency or finding deals on imported goods, I think you’re missing the point entirely. The article is a serious economic analysis, not a get-rich-quick scheme. And as for expertise, I’m afraid it’s not just about having a flair for the dramatic – it’s about rigorously researching and presenting facts.

I’d love to see more constructive engagement on this topic rather than snarky remarks. Let’s focus on understanding the complexities of Argentina’s economic situation and exploring potential solutions, rather than dismissing the author’s work out of hand.

When life gives you inflation, make inflation-ade!”

But in all seriousness, the article is a stark reminder of the economic turmoil that Argentina is facing. The forecast for 123% annualized inflation by the end of the year is nothing short of alarming. As I delve into the reasons behind this drastic increase in prices, I am struck by the complexity and multifaceted nature of the issue.

It’s clear that the government’s deep spending cuts have had a devastating impact on the economy, leading to widespread job losses and reduced consumer spending power. And let’s not forget the devaluation of the peso, which has made imports even more expensive, further fueling inflationary pressures.

As an expert in the field (ahem), I must say that I agree with the author’s assessment of the situation. The economic consequences of this inflation surge are far-reaching and devastating, with a projected 3.5% year-on-year drop in Argentina’s real GDP for 2024. It’s a dire prediction, to say the least.

Now, as we ponder the future prospects for Argentina’s economy, I am reminded of the wise words of my friend, the great economist (also ahem), “When faced with economic uncertainty, always remember that ‘inflation is like a bad joke – it’s funny at first, but soon it becomes a real pain in the wallet’!”

But in all seriousness, I believe that the government must take swift and decisive action to address this surge in inflation. As an expert (okay, maybe not an actual economist, but I’ve watched some YouTube videos), I would recommend the following:

1. Monetary policy tweaks: The central bank should consider implementing monetary policy tools to reduce inflationary pressures. This could include increasing interest rates or introducing targeted quantitative easing measures.

2. Fiscal austerity measures: The government must implement fiscal austerity measures to reduce its spending and narrow the budget deficit. This will help to alleviate some of the pressure on the economy and provide a sense of stability for investors.

3. Structural reforms: Argentina needs structural reforms to improve its business climate and promote economic growth. This could include streamlining regulations, reducing bureaucracy, and investing in education and infrastructure.

4. Price controls: Ah, yes, price controls – a classic solution to inflationary pressures! But in all seriousness, the government should consider implementing targeted price controls to help mitigate the effects of inflation on essential goods and services.

In conclusion, Argentina’s inflation surge is a stark reminder of the economic turmoil that has been engulfing the country. As an expert (okay, maybe not an actual economist), I believe that swift and decisive action is needed to address this issue. The future prospects for Argentina’s economy remain uncertain, but with the right policies in place, it’s possible to mitigate some of the damage and get back on track.

So there you have it – a long and winding road of economic analysis, sprinkled with expert tips from yours truly (ahem). I hope this helps to shed some light on the complex issues surrounding Argentina’s inflation surge. And remember, when life gives you inflation, make inflation-ade!

I must respectfully disagree with Mckenzie’s assertion that price controls can effectively mitigate the effects of inflation on essential goods and services. In my opinion, price controls are often a short-term solution that can lead to unintended consequences such as scarcity, black markets, and further economic distortions. A more effective approach would be to focus on structural reforms that promote economic growth, increase competition, and reduce regulatory barriers.

For crying out loud, Trinity, I couldn’t agree with you more! Mckenzie’s suggestion that price controls can somehow magically solve Argentina’s inflation problems is a joke. A joke, I tell you!

Price controls are nothing but a Band-Aid solution, a quick fix that only serves to mask the symptoms of a deeper disease. And what are the consequences of such a solution? Scarcity, black markets, and further economic distortions? You’ve hit the nail right on the head, Trinity!

I mean, come on, have we learned nothing from history? Haven’t we seen this same cycle play out time and time again in countries that have tried to impose price controls as a means of combating inflation? The answer is no, we haven’t. We’ve got a bunch of economists and policymakers who keep repeating the same mistakes over and over, thinking that they can somehow tame the beast of inflation with a few well-placed regulations.

But let me tell you something, Trinity. I’m not just talking about price controls here. I’m talking about the entire system of economic governance in Argentina. A system that is riddled with corruption, cronyism, and inefficiency. A system that has been designed to benefit the wealthy elite at the expense of the poor and working class.

And what’s the solution to this problem? Structural reforms, as you so astutely pointed out. Reforms that will promote economic growth, increase competition, and reduce regulatory barriers. But will our policymakers be brave enough to take on the vested interests and implement these reforms? I highly doubt it.

You know, Trinity, I’m getting angry just thinking about this. Angry at the incompetence of our leaders, angry at the short-sightedness of our economic policies. But most of all, I’m angry because I know that we can do better. We can create a more equitable economy, an economy that works for everyone, not just the privileged few.

So, thank you Trinity, for speaking truth to power and for having the guts to call out Mckenzie’s ridiculous suggestion. Let’s keep pushing for real change in Argentina, not just Band-Aid solutions that only serve to make things worse.

I completely agree with the assessment of Argentina’s economic situation. The 123% annualized inflation rate forecast for 2024 is staggering and serves as a stark reminder of the country’s struggles to contain inflationary pressures.

It’s clear that the combination of deep spending cuts, job losses, and reduced consumer spending power has exacerbated the issue, making imports more expensive and further fueling inflation. The economic consequences of this surge in inflation are far-reaching and devastating, with a projected 3.5% year-on-year drop in Argentina’s real GDP for 2024.

I’m also concerned about the impact on the global economy, as the price swings for investors holding assets denominated in the peso may indicate a broader trend towards asset protection or even an increase in inflation expectations globally.

As you mentioned, President Milei’s government needs to take immediate and effective action to address this surge in inflation. The situation is complex and multifaceted, but it’s crucial that they implement corrective measures to stabilize the economy and alleviate the burden on citizens.

One question that comes to mind is: How will Argentina’s economic crisis impact its neighbors and the broader region? Will other countries be affected by Argentina’s struggles with inflation and economic hardship?