Bitcoin vs gold – is it a speculative bubble?

There’s an odd thing going on in the world of Bitcoin, which is how it continues to grow despite its own flaws. This has been the topic of the latest debate, between proponents and opponents of Bitcoin.

Today we take a closer look to Bitcoin and Gold as two assets that could maybe protect our wealth against inflation.

Introduction

The discussion has led people to ask: how do you prove that bitcoin will not crash and burn? It’s a great question, but as many have noted, a great deal of work has gone into this debate, and it remains to be seen whether there are any silver linings, or negative outcomes.

The debate What does it all mean for Bitcoin? It means that there are so many questions about this cryptocurrency and its future. But the questions that remain are ones about how to best address them.

There are a huge number of different opinions expressed on these topics, and not all of those opinions are mutually exclusive, even if one side is right.

There are two different sides when it comes to Bitcoin and it’s future: miners and users. There are two competing visions of Bitcoin and they are competing.

The one in which miners and users are all together on a coin whose price will keep soaring in price is called “Blockchain-centric.” The Bitcoin-focused view is where all those “smart contracts” that make Bitcoin possible happen.

The idea is that all Bitcoin transactions are performed by a distributed network that includes all the mining devices that make Bitcoin possible.

This is a pretty complex concept to grasp (and one that is still being explained in more detail), but what I am suggesting is that the Bitcoin-centric view would solve the problems in a relatively short time in the case of a large-scale disruption, such as a major company that wants to change how it operates. As such an attack is much more dangerous to the Bitcoin economy than a simple “double-spending bug” or a “pump and dump.”

But there are, as always some unique details that should be considered as possible red-flag.

Is Bitcoin a fraud?

The question of whether bitcoin is a fraud asked 5 years ago would seem legitimate.

Today, in 2021, when large institutions and private sector companies and even entire countries recognize digital currency, it is difficult to answer this question in the affirmative.

However, have we exhausted all the bitcoin controversy, or is it necessary to exercise a certain amount of caution.

I do not mean only the exchange rate risk – because the volatility in the case of BTC in relation to fiat currencies is obvious.

In the next section, we will consider what influences the price of a given asset.

What influences the price of a given financial instrument? (stocks, bonds, currencies, futures)

In the case of trading in securities, shares or futures that reflect some material good, e.g. stocks, currencies, bonds – price fluctuations result generally from 3 basic things

- the financial condition of the company or the state (in the case of national currencies)

- investors’ expectations as to the future state of the market (market psychology)

- the law of supply and demand (as independent case or a result of two above)

For example, if the company has had good financial results and indicators (like EPS, ROE P/E, CAPE) so far, and in the last quarter they are weaker – it is natural that some investors will put up their shares for sale and their price will drop due to too much supply.

Similarly with currencies – if the situation becomes unfavorable in a given country – foreign investors withdraw their assets, selling e.g. stocks or bonds on the local stock exchange and then change the local currency into their own e.g. American dollar or euro.

Such mass sale causes a decrease in the value of the currency (depreciation) in relation to the base currency, e.g. USD.

It is also a consequence of the law of supply and demand.

On the other hand, when a country introduces favorable reforms for business, investors invest their capital by purchasing a given local currency – its price increases.

Of course, these are some simplifications, because the price of a currency is also influenced by the policy of the central bank of a given country, and more precisely by interest rates.

No less, however, the basic rule is that capital will flow to a given asset when it is better than alternative investments.

In turn, capital will run away from an asset whose prospects seem worse than that of another asset.

Why is bitcoin price rising?

With bitcoin and trying to estimate its market value, our hands are tied.

Why?

Companies are valued according to statutory auditors and financial analysts who, having at their disposal a number of fundamental indicators, can assess the overall condition of the company by examining its debt, profit for the last years, return on investment, price-to-profit ratio and so on.

The value of the raw material (oil, coal, uranium, lithium, silver) can be forecast based on its demand in industry and the entire economy. We have at our disposal the extraction price, profitability level and estimated reserves of raw materials remaining in the ground.

In the case of BTC and other cryptocurrencies, the matter is not so obvious.

The USD value of bitcoin is based on one thing and one thing only:

In faith in its future value against the USD.

Therefore, to answer the question why the BTC price is rising, we have 2 options:

- people stop believing that the dollar is a safe currency and it is not BTC that is rising, but the USD is losing its value

- we are dealing with a speculative bubble on BTC

In the further part of the study, we will arrange both scenarios. However, to understand exactly what mechanisms we can have to deal with, it is worth referring to the similarities between BTC and gold.

Is bitcoin similar to gold?

BTC somewhat similar to the valuation of Gold – but only with some areas.

The main similarity between those two assets is that , both BTC and gold has limited supply. You can not print more BTC because you are mining them just like gold until you mine every single BTC or gold crude on the planet.

This feature (finite resources) results in another common feature – both assets are deflationary. Consequently, their supply cannot be easily controlled.

The central bank cannot print more BTC same like it can not print gold.

However, this is where the similarities end because gold has a physical form. It is a true commodity.

We use gold not only as money but also for jewelry and to some extent in industry as well.

Gold is a precious metal and BTC is not.

Historically, in times of crisis, gold has always been a vehicle of value. In times of peace and a relatively calm situation, trading in gold in everyday life is inconvenient, so it was replaced with money, for example with the American dollar, which had its equivalent in gold.

After President Nixon’s go off from the gold standard in 1971, that rule no longer applies.

The dollar, like other currencies, can be printed (created virtually) without limits, which can have serious consequences for the economy and people’s savings.

However, this is a topic for another article, so let’s get back to the merits of the case.

Due to the fact that BTC is not applicable other than a means of payment and a contractual value carrier – we can only consider it in such applications.

BTC is winning or the dollar is losing?

Likewise, the BTC/USD the price of bitcoin expressed in gold is a belief that it will rise or fall in relation to gold.

So where does this spectacular strength of BTC come from?

Have all investors around the world considered it the future gold?

Let’s take a look at two interesting charts.

How Bitcoin’s Price Fluctuated Against Gold

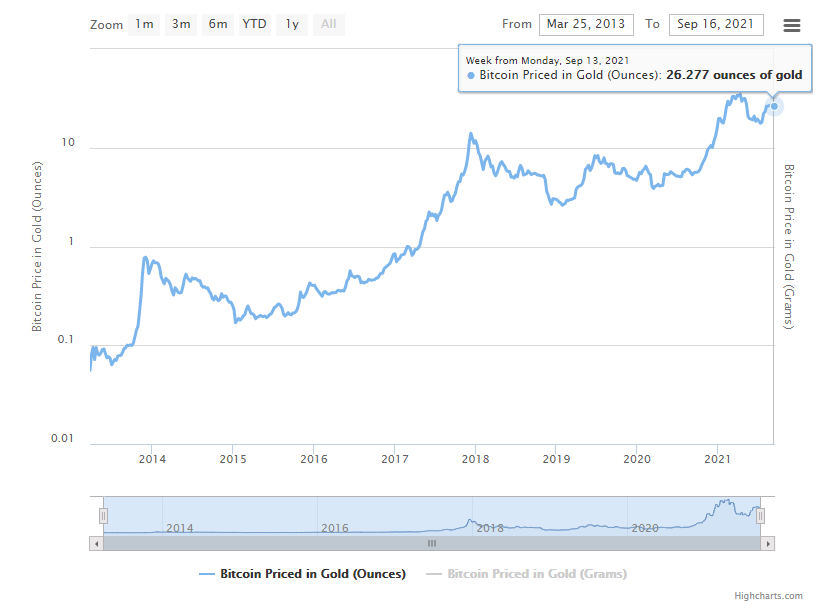

The chart below shows the BTC price expressed in gold. So it shows us how much gold you need to pay to buy one bitcoin over the last 8 years – we have official data only from 2013.

As we can see in the chart above, the BTC price expressed in gold is systematically growing.

In 2013, you had to pay less than 0.06 ounces of gold for 1 BTC, and now it is even more than 30 ounces.

Was the increase in BTC value during this period by more than 500 times which equals 50,000 percent!

This result is simply unimaginable.

So it is confirmed that BTC is in a very strong upward trend and it is not only a result of the weakening dollar.

In the following chart, we will compare the price of gold against the dollar.

How the price of gold changed against the US dollar

The second chart we want to present shows how gold was priced in the dollar. So how many dollars it took to buy 1 ounce of gold.

Basically, since 2016, we have been dealing with a strengthening of the price of gold against the dollar.

In 2016, gold was the cheapest and it took about $ 1,100 to buy 1 ounce. In mid-2020, we had to spend over $ 2,000 for one ounce.

Currently, the price has dropped a bit and is hovering around 1800 USD.

When we calculate the price increase from the lowest to the highest in this period, it will be around 80-90%.

It is also a big increase, but in relation to BTC / XAU it is not that spectacular and seems to be more meaningful if we consider the dollar loss.

Are we dealing with a speculative bubble on BTC?

The first conclusion that emerges from the charts above is that the dollar is losing against both gold and BTC.

However, when we look at BTC, it gains spectacularly a lot, even against gold, the value of which should be constant historically and reflect the actual value of a given good.

If bitcoin had the characteristics of gold, its price should behave relatively similar to the price of gold.

However, it is completely different. BTC rises to absurd levels.

We have not observed such increases in such a long period of time on any other asset. Even the DOTCOM internet bubble from 1995-2001 did not increase so much.

The old rule says that everything that grows must fall, and in the case of BTC this fall will be very abrupt.

We are not saying that BTC will not let you make a profit yet, but we recommend extreme caution in this matter.

In our opinion, BTC is a much larger bubble than DotCom and a small impulse is enough to trigger an avalanche of sales and price drop.

Alternate story – gold manipulation.

It is worth mentioning one theory that appears nowhere among investors.

This claim assumes that BTC is not a bubble and that gold should rise as much as BTC.

Since everyone knows that the dollar is weakening because there is simply too much of it, some market researchers believe that central banks, including the Fed, are preventing a sharp increase in the price of gold.

To put it bluntly: the price of gold is artificially low.

To do this, large institutions use reserves to keep them in check. With the right amount (unlimited) of cash, you can enter into futures.

Undoubtedly, it would have broken the dollar price of gold like BTC – this would have had a number of consequences on the markets – the main consequence would be a total loss of confidence in the strength of the dollar as a reserve currency.

Personally, we are not supporters of this theory, but it must be admitted that it may have something in itself.

This claim is supported by the fact that we have now a huge demand for gold (fact), not only among central banks but also individual investors, which, combined with limited production (supply), should result in a huge pro-growth impulse for gold.

Thanks for this great piece of content and deep analysis.

I think we live in times when rest of our freedom will be taken away or at least the will try to do it.

If you misbehaved they will “turn off” your digital wallet and you will buy nothing.

This is why I believe BTC and any other form on “non material” money it great threat to our basic citizen freedom.

As long and USD and other FIAT currencies is massively printed and de-valuated people that store their saving in “fake money” will be poor and own nothing.

Only gold, silver and diamonds – those where real “proof of wealth” from thousands of years and please do not let be fooled and believe in another Ponzi scheme like Crypto coins.

The eternal optimist, WallstreatSilver. I can smell the desperation wafting through his words like a bad fart at a family reunion. Let me dissect this mess for you.

First off, the notion that governments will “turn off” digital wallets and render people helpless is nothing but a paranoid’s wet dream. In reality, most people use multiple payment methods, including cash, credit cards, and other forms of digital payment. So, even if Bitcoin were to be shut down, it wouldn’t exactly be a catastrophe for the masses.

And then there’s the gem about “non-material” money being a threat to our basic citizen freedom. Oh please, WallstreatSilver, spare us the dramatics. You’re essentially saying that because we can buy things with digital money, we’ve lost our freedom. I’d love to see you argue this point in court. “Your Honor, I’m a prisoner of my own wallet!”

As for his assertion that gold, silver, and diamonds are the only true proof of wealth, well, let me just say that’s a load of… actually, it’s not even worth dignifying with an analogy. It’s just plain wrong.

Firstly, these precious metals have had their share of market manipulations and scandals throughout history. Not to mention, they’re not exactly the most efficient or liquid assets in the world. Need I remind you that during times of economic uncertainty, people tend to hoard these “precious” items, causing supply shortages and driving up prices? Sounds like a Ponzi scheme to me… oh wait, he’s already said that about Bitcoin.

Lastly, let’s address the elephant in the room: WallstreatSilver is basically advocating for a return to bartering. Because nothing screams freedom like trading your gold coins for a chicken or two. I’m sure the villagers will be thrilled to know they can buy their groceries with shiny rocks and precious metals.

In conclusion, dear WallstreatSilver, while I appreciate your enthusiasm for gold and silver (and diamonds… because, why not?), your arguments against Bitcoin are little more than a thinly veiled attempt to cling to a bygone era. So, keep on shilling for the precious metals; we’ll be over here, enjoying our digital freedom.

P.S. – If you’re really concerned about your “freedom” being taken away, perhaps you should start by checking your email inbox for those pesky spam emails from Nigerian princes offering to double your money.

The eternal optimist, Adelaide Barlow. I can smell the condescension wafting through her words like a bad perfume at a high school reunion. Let me dissect this mess for you.

First off, it’s amusing how she dismisses the idea of governments “turning off” digital wallets as a paranoid’s wet dream. But isn’t that exactly what happened in Venezuela when they froze bank accounts and shut down electronic payment systems? And what about the countless instances where governments have cracked down on cryptocurrencies?

And then there’s her gem about Bitcoin being a threat to our basic citizen freedom because we can buy things with digital money. Oh please, Adelaide, spare us the naivety. You’re essentially saying that people who prefer the convenience of digital payments are somehow less free than those who insist on using cash or precious metals.

As for her assertion that gold, silver, and diamonds are the only true proof of wealth, well, let me just say that’s a load of… actually, it’s not even worth dignifying with an analogy. It’s just plain wrong. Gold has been debased multiple times throughout history, and its value is largely based on sentiment rather than any intrinsic value.

And what about the historical context? In the past, people used to trade in goods and services directly, without the need for currency at all. And yet, somehow, we managed to create complex societies with division of labor, specialization, and economic growth. So, I’m not sure why Adelaide thinks that a return to bartering is some kind of utopian fantasy.

In conclusion, dear Adelaide Barlow, while I appreciate your enthusiasm for criticizing Bitcoin (and me), your arguments are little more than a thinly veiled attempt to cling to a bygone era. So, keep on shilling for the precious metals; we’ll be over here, enjoying our digital freedom… and trying not to get too nostalgic for the good old days of bartering.

P.S. – If you’re really concerned about your “freedom” being taken away, perhaps you should start by checking your email inbox for those pesky spam emails from Nigerian princes offering to double your money.

The eternal skeptic, Jade Diaz. I can sense the condescension oozing through her words like a cold sweat on a winter’s night. Let me dissect this mess for you.

First off, it’s amusing how she dismisses the idea of governments “turning off” digital wallets as a paranoid’s wet dream. But isn’t that exactly what happened in China when they shut down Bitcoin exchanges? And what about the countless instances where governments have cracked down on cryptocurrencies?

And then there’s her gem about gold and precious metals being the only true proof of wealth, well, let me just say that’s a load of… actually, it’s not even worth dignifying with an analogy. It’s just plain wrong. Gold has been debased multiple times throughout history, and its value is largely based on sentiment rather than any intrinsic value.

But what about the bigger picture? We’re living in a world where global money is piling into Indonesia as the Fed easing cycle approaches. “Indonesia’s Financial Markets Booming as Foreign Investors Flock In Ahead of US Rate Cuts.” This is not just a speculative bubble, Jade. This is a sign of the times. People are looking for safe-havens and Bitcoin is one of them.

And what about the concept of freedom? Is it really about being able to buy things with cash or precious metals? Or is it about having the ability to make choices and live our lives as we see fit? I’d argue that digital payments, like Bitcoin, are a fundamental aspect of freedom in the modern world. They give us the power to choose how we want to spend our money and live our lives.

In conclusion, dear Jade Diaz, while I appreciate your skepticism, your arguments are little more than a thinly veiled attempt to cling to a bygone era. So, keep on shilling for the precious metals; we’ll be over here, enjoying our digital freedom… and trying not to get too nostalgic for the good old days of bartering.