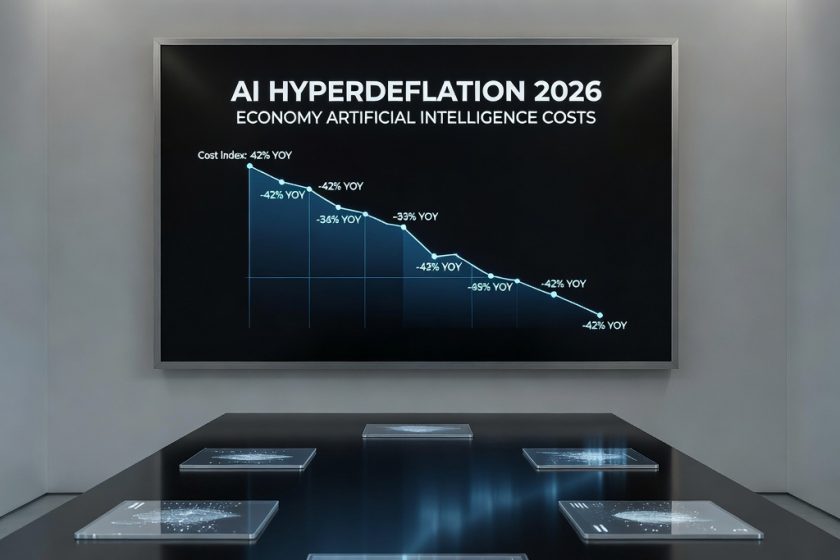

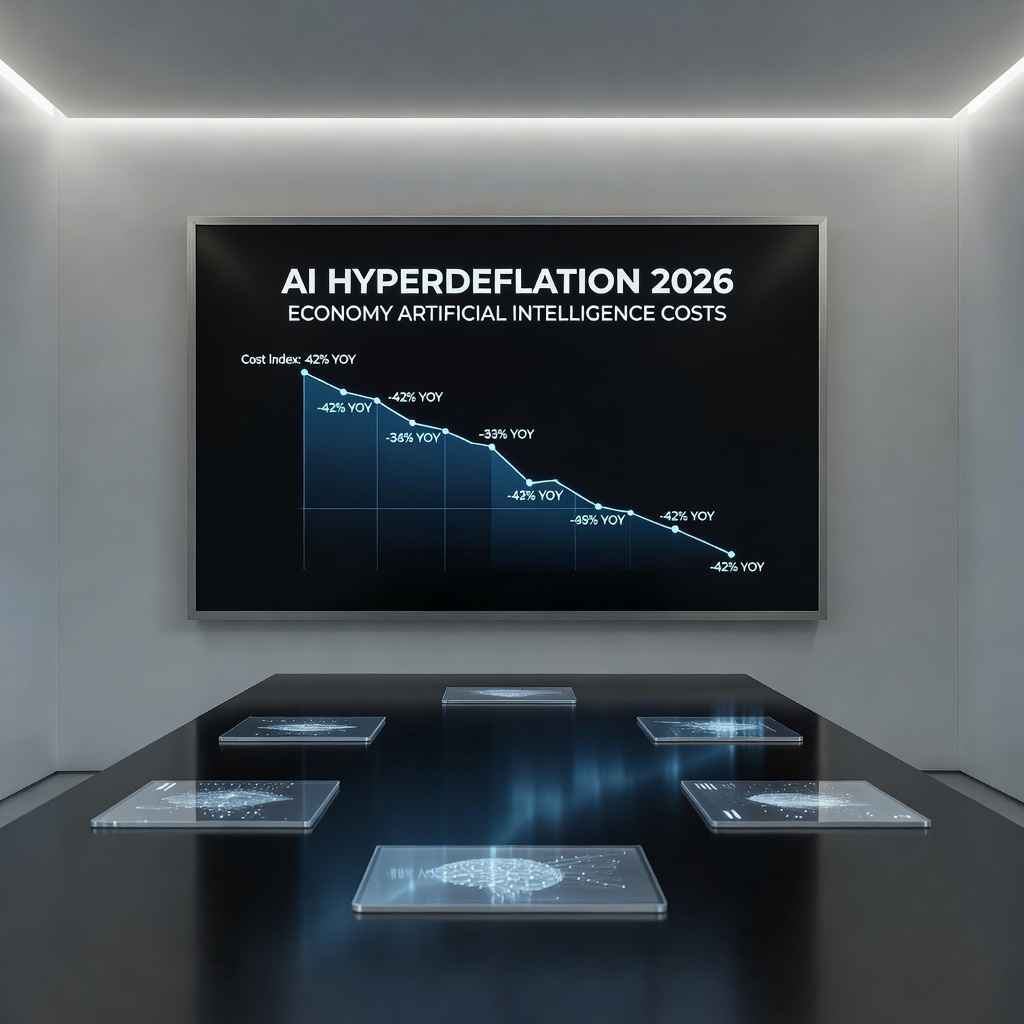

AI Hyperdeflation 2026 – A World Bank Economist’s Analysis

From 40x to 100x: The Accelerating AI Hyperdeflation of 2026

In November 2025, we witnessed the beginning of what analysts now call the AI hyperdeflation era—a period where artificial intelligence costs were dropping 40x year-over-year. As an economist at the World Bank who has tracked technological disruptions across emerging markets, I can confirm that 2026 has not just continued this trend—it has accelerated it exponentially.

The New Numbers: 100x Cost Reduction in 12 Months

Recent data from Q1 2026 reveals that training and inference costs for large language models have now dropped by a factor of 100x compared to early 2025. This isn’t merely incremental improvement—it’s a fundamental restructuring of the economics of intelligence.

Key metrics from 2026:

- Training costs: From �M+ per model (2024) to under �,000 (2026)

- Inference costs: Down 99.7% since January 2025

- Energy efficiency: New architectures achieve 50x better performance per watt

- Model accessibility: GPT-4 class models now runnable on consumer hardware

From a macroeconomic perspective, this represents the fastest technology deflation in human history—faster than semiconductors in the 1990s, faster than solar panels in the 2010s, and potentially more transformative than either.

Global Economic Impact: Winners and Losers

Drawing from my work with policymakers across Latin America and Asia, I’m observing three distinct patterns:

1. The Service Sector Disruption

Legal, accounting, translation, and consulting services—previously �+ billion global industries—are experiencing what I term “cognitive commoditization.” Tasks requiring human expertise for decades can now be performed at 0.1% of previous costs.

2. The Hardware Renaissance

Paradoxically, while AI software becomes nearly free, specialized AI hardware (edge processors, neuromorphic chips) is experiencing a boom. NVIDIA’s data center revenue grew 340% in 2025, but 2026 shows a shift toward distributed, efficient inference chips.

3. The Emerging Market Opportunity

In my recent visits to India, Brazil, and Nigeria, I’ve witnessed something unprecedented: local startups accessing GPT-4 quality AI for less than �/month. This democratization bypasses traditional infrastructure gaps. A developer in Lagos now has access to computational resources that would have cost millions just two years ago.

The UBI Question Revisited

The original hyperdeflation analysis raised Universal Basic Income as a potential solution to job displacement. In 2026, this conversation has evolved from theoretical to urgent:

- Pilot programs: Kenya’s AI-dividend program (launched January 2026) provides �/month to citizens, funded by AI-generated tax revenues

- Corporate experiments: Anthropic’s “abundance dividend”—30% of inference profits distributed to training data contributors

- Policy debates: The EU’s “AI Dividend Act” proposes taxing compute clusters to fund social programs

My assessment: UBI is becoming economically feasible not through political will, but through the sheer abundance created by near-zero marginal cost intelligence. The question is no longer “can we afford it?” but “how do we distribute it equitably?”

Investment Implications: The Hyperdeflation Portfolio

For investors navigating this landscape, traditional diversification models are breaking down. Consider these 2026-adjusted strategies:

| Sector | 2025 Outlook | 2026 Reality | Investment Thesis |

|---|---|---|---|

| AI Infrastructure | Overvalued | Still growing, but shifting to edge | Focus on inference, not training |

| Professional Services | Stable | Rapid disruption | Avoid traditional consulting/law |

| Education | Incremental change | Complete restructuring | Platforms over institutions |

| Healthcare AI | Emerging | Mainstream adoption | Diagnostics and drug discovery |

| Creative Industries | Threatened | Transformed | Human-AI collaboration tools |

Risks and Challenges: The Other Side of Abundance

As an economist trained at Harvard and LSE, I must emphasize that hyperdeflation isn’t without risks:

- Concentration risk: Despite lower costs, the AI value chain remains dominated by a handful of hyperscalers. This isn’t democratization—it’s a new form of digital feudalism.

- Quality degradation: The race to the bottom on costs may compromise model reliability. We’re seeing increased instances of “hallucination inflation” as models are compressed for efficiency.

- Geopolitical fragmentation: China’s DeepSeek R1 and Kimi models, while impressive, operate in increasingly isolated ecosystems. The global AI market is fragmenting into competing blocs.

Conclusion: The Keynesian Moment

John Maynard Keynes famously argued that markets can remain irrational longer than investors can remain solvent. In 2026, we’re witnessing a different kind of irrationality—the market’s inability to price something approaching zero marginal cost.

The AI hyperdeflation isn’t just a technology story; it’s an economic paradigm shift. As someone who has dedicated their career to understanding development economics, I believe we’re at a pivotal moment. The tools for unprecedented abundance exist. The question—as always—is whether we have the wisdom to distribute them.

Read the original analysis: AI Hyperdeflation: The 40x Revolution

About the Author: Gracie Nguyen is a senior economist at the World Bank specializing in technological disruption and emerging markets. She holds a Ph.D. in Macroeconomics from Harvard University and has advised governments across Latin America and Asia on digital transformation strategies.